The Rise of Cloud FinOps: Unlocking Cloud Cost Optimization

According to Gartner’s prediction, “Organization spent on Public cloud enablement is projected to reach $675.4 billion in 2024, at a CAGR of 20.4%”. Over 30% of cloud spending was wasted and inefficient, costing billions of dollars in loss.

As organizations continue to adopt public cloud infrastructure at a torrential pace, traditional IT financial processes often fall short of addressing dynamic cloud consumption patterns and complex migrations, leading to a lack of visibility into sources of cost overruns. The rise of cloud financial management, FinOps, offers an arsenal of tools, resources, and wisdom to streamline financial overspending and regain control to achieve fiscal responsibility and business agility.

This blog explores how the FinOps framework is transforming cloud cost management, providing valuable insights into its core principles, strategies, and roadmaps, enabling businesses to optimize their cloud spending, enhance visibility into expenditure, and foster cross-functional collaboration across teams.

Common Billing Errors in Cloud Services

- The complexity of billing statements: Cloud billing statements are often intricate and lengthy as it has billing metrics that can vary between providers, resulting in billing statements and misinterpreting costs and confusion.

- Hidden Charges: Additional charges, often stemming from unauthorized usage, misconfigured services, or shadow IT projects, can lead to billing disputes and financial discrepancies. It’s essential to be vigilant and maintain control to avoid these issues.

- Over-Provisioning and Idle Resources: Organizations may often inadvertently over-provision resources more than necessary or fail to shut down idle instances, resulting in unnecessary costs. This often happens when multiple teams share resources.

- Multi-cloud Environments: Multi-cloud environments pose significant challenges due to different billing structures and terminologies, making it difficult to track overall cloud consumption effectively.

- Recursive Function Costs: Recursive Function often leads to unexpectedly high charges rapidly even before budget alerts trigger, especially in a serverless environment.

- Service Overlaps: Service overlaps can drive significant costs; for instance, simultaneously running multiple instances for redundancy without proper monitoring and governance may lead to unnecessary expenses.

Effectively managing cloud costs is crucial due to the intricate complexities of negotiated rates and diverse pricing models. To combat these challenges, adopting a FinOps strategy is imperative for organizations to actively monitor and optimize their cloud spending in real-time, ensuring it aligns with their business objectives.

What is FinOps?

Cloud Financial Operations [FinOps] is an operational framework that optimizes cloud spending while maximizing business value and keeping budgets under control. This cultural practice enhances the collaboration between technical, finance, and business teams to ensure effective resource utilization. It is not just merely cutting costs but ensuring real-time visibility and accountability into cloud usage, enabling organizations to understand their cloud costs better and make informed decisions.

“According to McKinsey, implementing FinOps (cloud financial management) can enable organizations to decrease their cloud expenses by 30% to 40% and cut down wasted cloud resources by as much as 35%.”

Three Phases of FinOps Framework

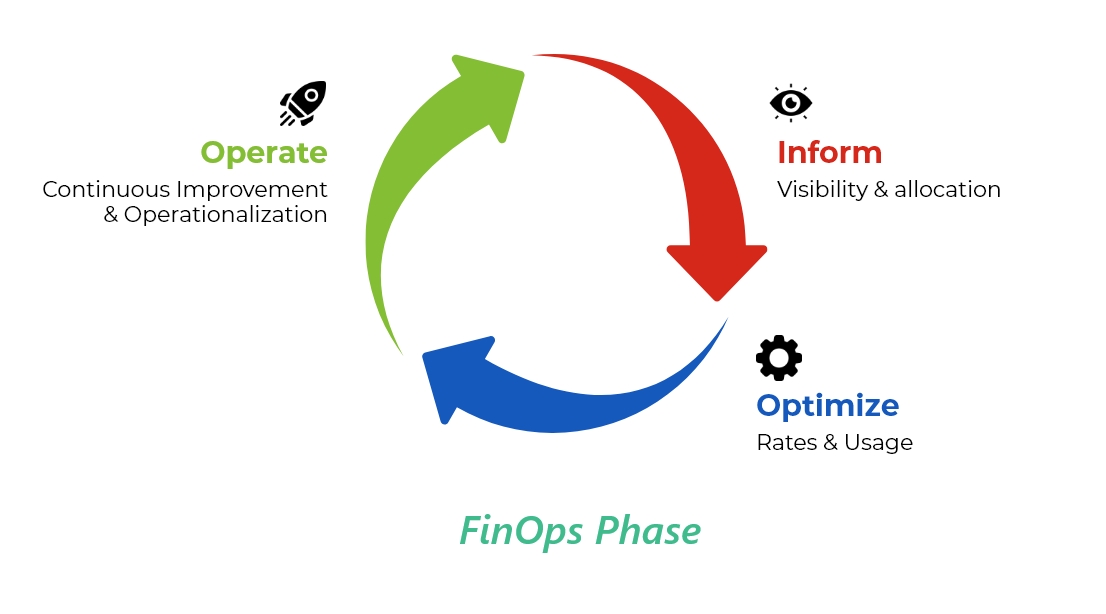

Beyond cloud cost management, FinOps offers a strategic approach for organizations for their cloud spending. The FinOps framework consists of three tenants: Inform, Optimize, and Operate, emphasizing cloud cost reporting, optimization, and continuous improvement.

Inform (Visibility and Allocation)

In the inform phase, FinOps helps organizations gather insights into data sources for cloud costs, usage, and efficiency from CSPs. By leveraging this data for allocation, analysis, and reporting, teams can enhance their capabilities in budgeting and forecasting trends and empower organizations to make informed decisions that optimize their cloud investments.

Optimize (Rates & Usage)

This phase focuses on identifying opportunities for enhancing cloud efficiency and additional cost savings by leveraging the capabilities developed in the Inform phase. It involves various options for resource optimization, including rightsizing unused assets, optimizing the container costs, maximizing the reserved instances, adopting modern architecture, and managing workloads. It ultimately improves visibility and reporting processes that align with organizational value and their cloud investments.

Operate (Continuous Improvement & Usage)

This phase involves implementing organizational changes to improve FinOps practice through establishing cloud governance policies, compliance monitoring, empowering practitioners to create basic budgets, and forecasting by evaluating performance that is aligned with business objectives.

Six Core Principles of FinOps Framework

- Planning and Budgeting: A recent FinOps foundation survey revealed that “nearly 20% of cloud-based application owners do not validate their cloud usage budgets.” Planning and budgeting are essential components of FinOps strategy as they provide tools for planning, controlling, and optimizing cloud spending as it serves as a catalyst for directing the organizations.

- Visibility: The cost of cloud infrastructure is transparent to everyone involved, allowing them to fully understand the impact of their actions on the bottom line and make confident, informed decisions.

- Cost Optimization: FinOps aims to optimize cloud spending by implementing various techniques for rightsizing resources, eliminating waste, and improving efficiency in cloud environments.

- Accountability: FinOps allows everyone involved in the cloud infrastructure to take responsibility for their costs and work together to optimize spending to drive financial accountability.

- Collaboration: It emphasizes the shared fiscal responsibility model of the FinOps model, fostering cross-functional communication between finance and technical teams to align cloud spending with business objectives.

- Governance: Accelerating business value begins with establishing frictionless cloud governance policies to streamline IT financial operations and cloud spending. Moreover, it is crucial to empower IT, finance, and business teams with training to manage and deploy the resources effectively.

Case Study: A Leading Media Asset Management Company Achieves 30% Cost Savings with FinOps Framework.

A leading media and broadcast management had encountered several challenges such as inflated cloud bills, minimal insight into the cloud usage and spending due to over-provision of cloud resources. Our cloud FinOps experts conducted a cost optimization process, including identifying underutilized cloud assets and recommending rightsizing strategies. With our holistic approach, the client has achieved a 30% reduction in their cloud spending without compromising performance, ensuring effective resource utilization and increased accountability, ultimately driving long-term business growth and success.

Discover How Our FinOps Framework Controls Rising Cloud Costs!

Roadmap for Successful Cloud FinOps Adoption

- Define clear cloud cost management goals: Define the crystallized objectives of the Cloud FinOps journey with suitable key performance indicators (KPIs) to monitor its progress toward achieving its objectives.

- Create a team to assess the current financial practices: Conduct a thorough assessment of your organization’s existing financial practices of cloud usage. Identify the areas where cost optimization can be improved.

- Implement cost allocation strategies: Strategically implement robust cost allocation strategies to effectively track and attribute the cloud costs across departments and projects that are aligned with organizational FinOps goals.

- Embrace Chargeback: Chargeback is the process of attributing cloud costs back to specific departments or project teams. By leveraging chargeback mechanisms, FinOps ensures responsible cloud consumption and assigns activities based on budget constraints, enabling organizations to make informed decisions.

- Integrate Showback: Showback is a vital component of the FinOps Framework, navigating the complexity of cloud finances by creating financial awareness and accountability within the organization, even if the actual costs are not being charged back. This proactive approach is especially useful in the early stages of FinOps.

- Fostering a Culture of Continuous Optimization: Regular assessment and adjustments of your Finops practices are paramount for evolving business needs.

- Rightsizing Resources: Rightsizing involves adjusting cloud resources to optimize balance performance and cloud costs. This process requires a thorough understanding of current resource costs and utilization, including metrics like CPU and memory usage obtained from monitoring tools.

Challenges in Implementing Cloud FinOps

While cloud FinOps provides tangible benefits, some significant challenges may arise due to the process, technical implementation, or general perception of the changes within the teams.

- Cultural Shift: Cloud FinOps requires a cultural shift where financial accountability and responsibility are shared across the organization. This can be difficult in companies where business units, finance, and technical teams operate in silos, leading to a lack of collaboration on budgeting and planning on resource management.

- Complexity of Multi-cloud Environments: The dynamic and complex nature of hybrid or multi-cloud environments presents significant challenges due to the unique pricing models of different cloud providers. Therefore, a strategic approach is required to effectively place workloads and monitor and track them continuously to ensure cost efficiency and compliance.

- Data Integrity: As organizations are often overwhelmed with the sheer volume of data, it can lead to integration issues, inconsistencies, and the inability to uncover meaningful insights. Hence, ensuring the data integrity and accuracy for reporting and analysis is critical for effective decision-making.

- Tool Integration: Integrating FinOps tools with existing infrastructure can pose several challenges, especially in organizations with legacy infrastructure.

Despite these challenges, the journey towards efficient cloud cost management is paramount and rewarding, providing organizations with unparalleled insights and control over their cloud investments.

Embrace Your Cloud FinOps Journey with iLink Digital

Embarking on the cloud FinOps journey is no small feat; it is continuous learning, adapting, and improving the process. As public cloud enablement continues to grow, the demand for effective cost management will increase, making FinOps an essential strategy for businesses aiming to optimize cloud expenditures while ensuring every dollar spent on their cloud investments delivers maximum value.

With over two decades of experience, iLink Digital empowers organizations to identify, optimize, and control their cloud footprint at scale. Our FinOps experts assist you in fostering a cost-conscious culture of accountability and establishing financial governance that aligns with the organization’s engineering practices and strategic goals, ultimately driving sustainable growth and innovation in the cloud era.

Let’s discuss your cloud challenges with our cloud expert today!